When I asked the AI system ChatGPT to generate an image of a diverse group of job candidates feeling happy about a great candidate experience applying for jobs, I got this:

A little creepy. Also, they were all dressed as white-collar professionals, although I didn’t prompt it that way.

When I asked ChatGPT to generate an image of a diverse group of hourly job candidates feeling happy about a great candidate experience applying for jobs, I got this:

Not sure why it misspelled “hourly candidates,” but it’s a little creepy just like the first one. Plus, these people are all in casual attire, which must be how the software interpreted and defined hourly candidates versus professional ones.

The Screening and Interviewing Priority

Regardless, the only way that people are really going to look this creepily happy is if they got the job, which I didn’t specify in the prompts. I specified only if people applied.

The reality is that people won’t even look halfway happy until they get screened and/or interviewed for the jobs they’re interested in.

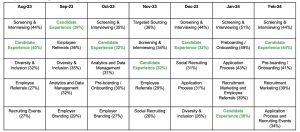

For the third month in a row, and for the last five out of seven months, screening and interviewing has been the No. 1 CandE Pulse priority. This is our monthly survey of our CandE community and beyond asking TA leaders and recruiters what their top recruiting priorities are and much more (the February 2024 results are below).

And unlike the creepy AI-generated pictures above, there are definitely real distinct differences between the professional and hourly candidate experiences across the candidate journey. Based on our latest 2023 CandE benchmark data from over 170,000 North American candidates (the global CandE benchmark research of over 240,000 candidates is available here), here are some of the differences we found between hourly and professional candidates

- 84% of hourly candidates had one to two interviews vs. 65% of professional candidates (a 26% difference).

- As the number of interviews climbed to three to four, professional candidates had 70% more at this volume than hourly, which makes sense. Hourly candidates across industries tend to have a quicker interview stage overall with fewer interviews that can conclude with being hired onsite. Fewer candidates in both camps had this many interviews though — 13% hourly and 27% professional.

- When we got to five-plus interviews, professional candidates had 90% more interviews at this volume than hourly, although there’s even fewer candidates in both camps at this many interviews — 3% hourly and 8% professional.

- 56% more professional candidates had phone screens with recruiters than hourly candidates, but 85% more hourly candidates had in-person interviews than professional candidates.

- Professional candidates had 90% more virtual interviews than hourly candidates. Companies have definitely saved a bunch of time and money not flying folks in for interviews (which started during the pandemic). Virtual isn’t always the best experience for candidates, but in our 2023 research, there was only a 4% difference in interview fairness NPS ratings between virtual and in-person interviews.

For this year’s 2024 CandE benchmark research, we’re going to explore the differences between hourly and professional a lot more than we’ve done in the past.

Latest CandE Pulse: February 2024

We’re a little early this time with our latest CandE Pulse article prior to the February jobs report, but if we recap January again briefly, U.S. employers added 353,000 jobs in the first month of the year according to the Labor Department, way more than most analysts were expecting. The unemployment rate also held steady at a historically low 3.7%. Wages were up and inflation is now down to 3.09%.

Since January 2023, we’ve been been asking our CandE Community and beyond about what their priorities are month to month in our CandE Pulse surveys, and as mentioned above, for the third month in a row, and for the last five out of seven months, screening and interviewing has been the number one CandE Pulse priority.

It’s also great to see that Candidate Experience is back in the No. 2 slot, although technically it is tied with Screening and Interviewing (just tenths of a point difference). Priorities always fluctuate, and we’ve seen plenty of variation over the past year. This time Preboarding / Onboarding came in at No. 3, Recruitment Marketing at No. 4, and the Application Process and Recruiting Events were tied at No. 5.

Top 5 Recruiting and Hiring Priorities

As always, this is only the partial list of what we ask, and it’s clear that priorities can change. A lot. Every single month. Granted, it’s a different mix of employers responding to these surveys each month, but still a sample set of what the priorities currently are.

Our February CandE Pulse survey respondents represented over 100 employers. Nearly 50% were 2,500-100,000+ in total employee size, with another 25% with 500-2,500 employees, and the top represented industries were healthcare, education, services, finance and insurance, hospitality, manufacturing, construction, and transportation.

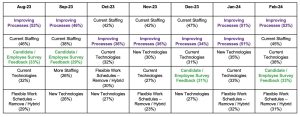

In addition to asking what employers’ priorities are month after month, we also ask them how they are going to get all the work done. Out of the top five each month, the most regularly recurring one is “Improving Processes.” This makes sense since it is where companies should tackle priority improvement and implementation first and foremost.

The next regularly recurring activity is “Current Staffing,” which also resonates with us and what we’ve heard from many in our CandE Community — that they are working hard to maximize they’re already thinner teams, just like in January. Current technologies were also key to getting recruiting done for employers in February, and we hope they’re continuously optimizing their tech stacks and their supposedly improved processes as well because they impact a big part of the candidate experience.

Candidate / Employee Survey Feedback is back in the top five, and of course we’re happy to see that. Employers have to have accurate and timely feedback data in order to improve their processes, and that includes participating in our annual CandE Benchmark Research Program and to consider investing in continuous candidate experience feedback with our survey partner Survale.

Top 5 Ways to Get It All Done

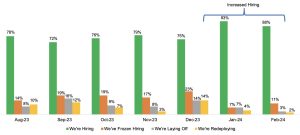

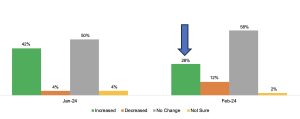

February CandE Pulse respondents said they’ve been hiring, and though hiring is down slightly, it’s still higher than it’s been since early 2023. Laying off and redeploying are also down. This all aligns with the Labor Department data and continues to contribute to the narrative of economic improvement.

Hiring Status

All job type hiring except senior leadership (contract, entry-level, hourly, professional, and management) were all down in February. It’s important to note that the mix of employers responding to our CandE Pulse surveys do vary each month, and it’s not all net new hiring, but seeing stable hiring month after month is promising.

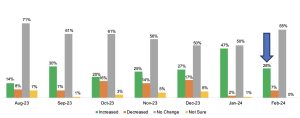

We also ask employers each month whether they’ve increased or decreased the size of their recruiting team. In February, increasing team size decreased 44%, but is still higher on average since last October at 28%. Those who said their recruiting teams decreased increased from 2% to 7%.

Increased or Decreased Recruiting Team Size

We’ve also started asking about whether or not recruiting budgets have increased or decreased, and in February, 28% of respondents said it had increased, which is down from January. We’ll have to wait a few months to see if there’s a greater trend here since the responding companies change each month. This will be something we’ll continue to monitor as it impacts the ability for TA and their teams to get their recruiting and hiring work done.

Increased or Decreased Recruiting Budget

We also ask each month about the job requisition load, and 92% in February said they manage up to 50 reqs each per recruiter, which is a little higher than in January 2024. However, we are going to phase out this question in March because we want to keep this survey to 10 questions, and there’s a new one we’re adding next month about recruiting technologies.

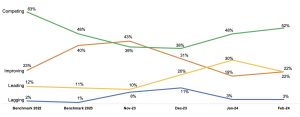

As we do each year in our benchmark research, and now monthly in our CandE Pulse surveys, we again highlight how employers self-rate their own recruiting and candidate experience and whether or not their leading, competing, improving, or lagging. Those who said they were lagging remained unchanged, while those who said they were improving increased slightly in February.

Otherwise, those who said they were competing increased to 52%, and those who said they were leading increased by 27%. Yes, these are self-ratings and are subjective, but we do hope those that said they’re competing, leading, and improving participate in the 2024 CandE Benchmark Research Program!

Self-Rating Recruiting and Candidate Experience

As we mention each month, there are those multi-year CandE Award winners that do it year after year (those employers that have above average ratings in our benchmark research, which ultimately is still a much smaller subset overall). You can see some of those CandE Winner differentiators in our Candidate Expectations Versus Employer Realities report and the complete 2023 CandE Benchmark Research Report that’s now available, complete with stage-based takeaways and CandE Winner case studies, including ones featuring Southwest Airlines and GuideWell.

The employers that respond to our CandE Pulse surveys each month vary, but we do know that no matter the mix, consistent recruiting and hiring while sustaining a quality candidate experience is difficult for most companies.

And it’s clear that screening and interviewing for both hourly and professional candidates are top of mind for employers. Recruiting priorities will certainly vary, but you should always keep your recruiting and hiring fully optimized, and your candidate experience positive and fair, all of which are key for your business and your brand.