You probably don’t need to see more data, more stats to understand that the last several months have been a difficult period for the staffing industry, but here they are anyway: A quarter of staffing businesses have seen a severe downturn in Q2 performance compared to last year, and half of staffing companies have had to let employees go, according to recent research by Bullhorn (conducted May through June).

What you might need to see data to believe, however, is the degree to which staffing professionals nonetheless remain optimistic about the future. Recruiters are bullish on both the outlook for their business and for the economy as a whole. Seventy-one percent of staffing professionals expect their company’s Q3 performance to go up or “way up,” and 55% expect the economy to recover this year.

This begs the question: Why are staffing pros so optimistic?

Who Is Optimistic?

While the staffing industry as a whole has struggled in the midst of the pandemic, it isn’t the case that every business in the industry has seen a dip in performance. A full 30% of respondents said business performance since the start of the COVID-19 crisis has improved or stayed the same compared to Q2 of 2019. Staffing type, sectors served, company, size, and regions of operation all had notable correlations with business success.

Given that a sizable number of staffing companies have weathered the storm so far, one might wonder if they are the source for optimism in the future. Are the businesses that have maintained steady performance the same ones that are most likely to expect things to improve?

As it turns out, no.

There is little correlation between business performance so far this year and expectations for the future. For example, respondents at staffing firms that saw performance improve and respondents at those that saw a downturn by more than 30% shared the same opinion on when the economy would improve — slightly more than half said it would happen in the remaining six months of 2020.

Likewise, region and sector served didn’t impact a respondent’s future outlook. Staffing companies that served the sector hit hardest, hospitality, reported identical outlooks to those serving healthcare, the sector with the strongest Q2 2020 numbers.

The one factor that does matter? The type of staffing a company specializes in. Temporary staffing professionals were far more likely than their counterparts in contract and perm placement to expect big things for the remainder of 2020 (62% compared to 51%). This may reflect industry expectations for demand in the remainder of 2020. As businesses reopen and demand for talent increases, temporary staffing may represent a safer gamble for employers that have recently laid off permanent staff.

Why Optimistic?

To understand why the industry is optimistic about the future, it helps to understand why the last several months were so difficult. When we asked respondents to share the biggest challenge they’ve faced since the pandemic began, there was one runaway winner: Respondents were most likely to cite reduction in job reqs as a top challenge to success (81%), more than failure of clients to make payments (20%) and increased difficulty in winning new customers (55%).

If low job reqs were the top reason that performance suffered, then an increase in jobs since the beginning of the crisis would help explain an uptick in optimism for the future. Our own firm’s statistics bears this out.

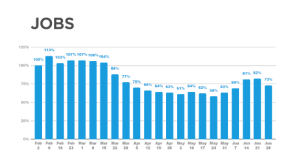

Using the week of February 2 as a baseline, we’ve measured the volume of jobs by our customers on a weekly basis. In April and May, jobs dropped to three-fifths of their pre-pandemic performance.

By June, there are clear signs of an upward trend. Should this continue, it supports the theory that industry professionals have reason to be optimistic about the future.

High Expectations for 2020 and Beyond

As we continue to observe a gradual incline toward normalcy in the industry, it isn’t just the practitioners who expect big things for the months ahead. Industry experts have also reported rosier outlooks than previously expected. Staffing Industry Analysts (SIA) projected a 2020 industry revenue of $126 billion in their July forecast. While this represents a steep 17 percent decline in revenue from last year, the expectations reflect a significant jump upwards from their $119 billion projection in April. And as the economy and the industry continue to recover, SIA anticipates double-digit growth in 2021.

As businesses reopen and look forward, it’s important to keep an eye on key indicators of the economy and business performance like job placements, submissions, revenue, and more. Other factors, like how the transmission of COVID-19 progresses throughout the year, will be harder to predict but equally important. Still, there is cause for optimism.