Search firms looking for growth markets might take a look at where angel investors are betting their money. In the first half of the year, over half the new investments went to three sectors: software, healthcare and retail.

Search firms looking for growth markets might take a look at where angel investors are betting their money. In the first half of the year, over half the new investments went to three sectors: software, healthcare and retail.

Two of those three are among the most competitive when it comes to hiring. Especially for tech startups, the competition for talent is not just against other like-sized firms, but against giants like Apple and Microsoft and Google.

In a post more than two years ago discussing how to recruit for startups, Robert Woo said, “If a stellar developer even comes within the vicinity of the office, he/she will be snatched up faster than an intern can be stuffed in the server room to make space.”

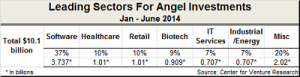

According to the Center for Venture Research at the University of New Hampshire, software got the largest share of investments with 37% of total angel investments in the first half of this year. Healthcare services/medical devices and equipment and retail each got 10% of the total investment dollars. Biotech was close behind with 9% of the total. IT services and Industrial/Energy got 7% each to round out the Center’s list of the top 6 largest sectors. Smaller percentages went to a variety of other startups and young firms in other sectors.

The number of active angel investors increased 6% in the first half over the first half of 2013. They also invested more money ($10.1 billion) in more (30,270) ventures, than in the same period in 2013. The average investment was $332,120.

However, a much larger share of the total investment went into funding growth of early stage companies, at the expense of post seed and start-up funding. Expansion stage financing climbed to 22% in the first half of 2014, an increase of 11% from the same period in 2013. The investments created a total of 96,860 new jobs or an average of 3.2 jobs per angel investment.

Now, with investors focusing more on startup growth and funneling the biggest share of investment dollars into software development firms, competition for talent among the tech startups, already keen, will continue to ratchet up, making company leaders more receptive to using agencies to fill their new jobs.

Other industries, where investment dollars are intended to fund growth, will also see increased competition for talent. Healthcare and biotech already are struggling to fill jobs in some areas. Add to that the need for young retail firms and emerging energy companies to find experienced professionals while competing with established players, and it opens up new opportunities for aggressive search firms.