Despite the emergence of RPOs as potent partners for talent acquisition, European TA leaders remain cautious to embrace the model. The market in Europe is nowhere near as developed as that in the U.S.or U.K. However, due to the rapid developments in technology and data, European TA leaders will increasingly find that in-house recruitment has some significant constraints that RPO does not have.

Over the past few decades, RPO in general has rapidly developed into a mature industry. Indeed, the market has been consistently growing in double digits and is expected to reach at least $21 billion globally by 2027.

Still, though there is an overall feeling that the European market has been part of that growth, data has been scarce. This has caused us to wonder whether the reality on the ground in Europe matches the hype. So, we set out to investigate the state of play in the European RPO market.

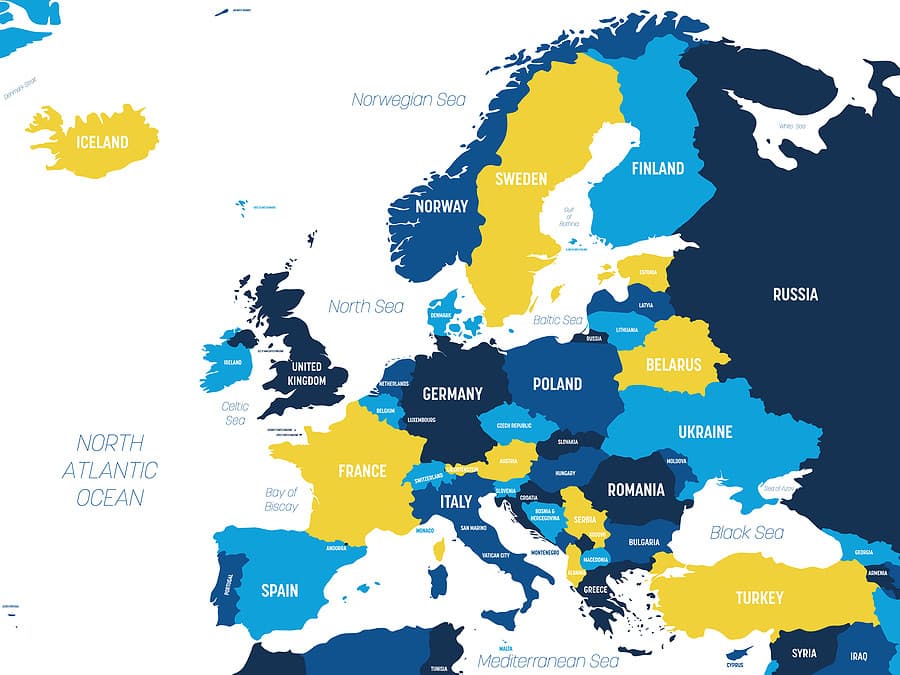

We started with an elaborate search in European business registries and found a grand total of 104 corporate entities using 16 major RPO players across European countries. Though the distribution is somewhat uneven with the north having a bigger concentration of RPO players than the south, it’s clear RPOs are pretty active in the European mainland.

Which means that RPOs are popular choices in Europe, right?

Not so fast.

We then looked at these companies’ income statements and compared them to those in the U.K. From this we determined that in general, businesses on the European mainland are an order of magnitude smaller than those in the U.K. While in the U.K. revenue is typically measured in the tens or even hundreds of millions of euros, in Europe the typical business size is under 10 million euros annually. When correcting for labor market size, on average European businesses generate about 15% percent of the business of their U.K. counterparts.

So, while there is a lot of hype when it comes to RPO in Europe, in reality, Europe is still an emerging market.

There are some obvious reasons for this. First, there is the fact the European market does not have one single language. Second, there is a patchwork of different regulatory regimes. Both of which make it harder for RPOs to scale their activities in Europe.

However, it seems this is not all. To get a better sense of the qualitative side of things, we did interviews with a number of TA leaders, which helped paint a picture that there is a reluctance to embrace the RPO model that seems to stem from the business culture. As one TA leader at a major semiconductor company told us:

“Outsourcing means you’re putting the responsibility somewhere else and asking them to decide how they’re going to do it. You’re putting the whole DNA of your organization in their hands. I would never do that, I would always want to keep ownership.”

Another leader at a large financial institution said:

“When you’re looking for marketing experts or account managers, that’s something you can outsource. In the IT domain or risk domain, you really need that knowledge in house.”

Though all this sounds reasonable, we believe that ultimately these TA leaders will be proven wrong — first and foremost, because it shows an outdated mode of thinking about what RPO is. RPO of today is no longer the RPO of 10 years ago. Nowadays, RPOs are keen to move up the value chain and add higher value services than they used to in the traditional outsourcing model.

Moreover, several trends are working in favor of using RPOs:

- There is the increasing speed of digitalization and automation. RPOs have bigger scale than in-house teams will ever be able to have. This means that they have the ability to leverage knowledge and skills across clients.

- There is the emergence of the total talent model, which merges temporary and fixed hiring. RPO players have already been making the shift to the total talent model, and their solutions are a perfect fit for organizations looking for complete solutions.

- The thinking about what defines recruitment success is changing. Ultimately, talent acquisition is about creating value for the business. Increasingly traditional indicators like time to hire and cost per hire are being replaced by more strategic measures. This elevates the discussion to the strategic level, which is where RPOs looking to move up the value chain want to be.

But there’s a more important trend: the increasing need for data and the increasing application of data analytics. To be able to win the war for talent, or the war for skills, you need mastery of both the inside as well as the outside data. This is also known as talent intelligence. RPOs already have more access to data than their clients, simply because they have a reach across businesses and industries. They also have the ability to synthesize all of this information.

Having the right data, properly trained recruiters, as well as the ability to monitor talent pools and effective employer branding — these are the things that define strong RPO providers nowadays. This makes them potent players in the battle for skills.

Still, this does not mean there is no place for in-house recruitment, of course. Sure enough, RPOs are looking to adopt a hybrid model where they work in a partnership and are complementary to in-house recruitment. Therefore, TA leaders don’t have to choose between outsourcing or in-house. They can have the best of both worlds.

In conclusion, with the talent shortages especially in northern Europe, further flexibility and internationalization of businesses, RPO will increasingly become a strategic option. While the language and legal differences between European countries and regions was a good reason to abstain from using RPO in the old-fashioned scalable way, RPO as it is in 2021 is very much an attractive model for TA leaders.